Sales forecast

Projection of sales is one of the most important parts of the business plan. We have included tables for three years (monthly and quarterly) and five years (annual). Three years should be the minimum, some may wish to include projections for five years.

Monthly sales projection 3 years

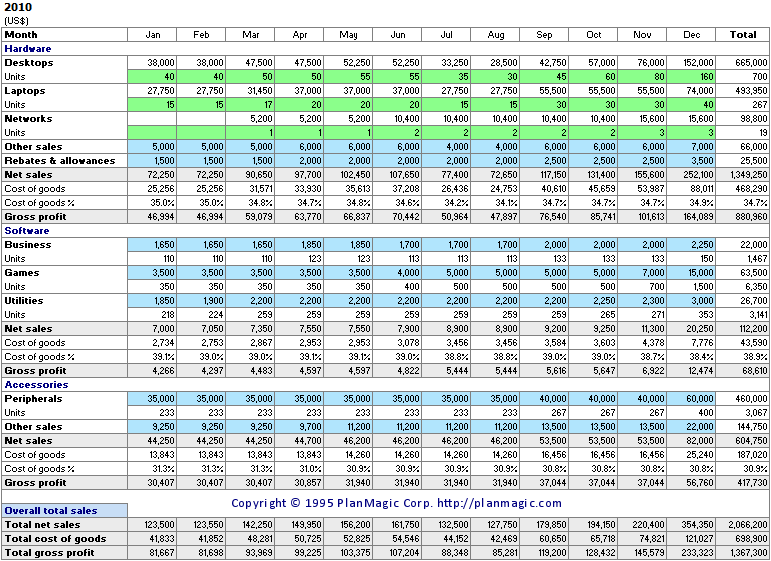

-- FIRST YEAR --

Sales by Units: Enter the estimated unit sales in each month of the 1st year.

Sales by Amounts: Enter the estimated monthly sales amounts in each month of the 1st year.

Other Sales: Each of the 10 product lines can include an additional row in the sales projection worksheets, where you can enter sales by total amounts. The cost of goods % is entered in the product details worksheet.

Rebates & Allowances: If you have added this row, you can enter rebate and allowances amounts as is needed.

-- SECOND & THIRD YEAR --

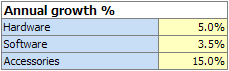

In the 2nd and 3rd year you only need to enter the Annual Growth % for each product line in the table provided. You can always overwrite the values as is needed.

Sales tax is calculated if you have entered any value in the Sales Tax table. Depending on the selection you've made in the Assumptions for Sales Tax Payment Period (Monthly, Bimonthly, Quarterly or Annual), the sales tax payments will be calculated in the Cash Flow Forecast accordingly.

Average growth %

In the 2nd and 3rd year you only need to enter the Annual Growth % for each product line in the table provided. You can always overwrite the values as is needed.

Sales projection quarterly 3 years

The quarterly worksheets are automatically completed from the 3-year Sales Projections.

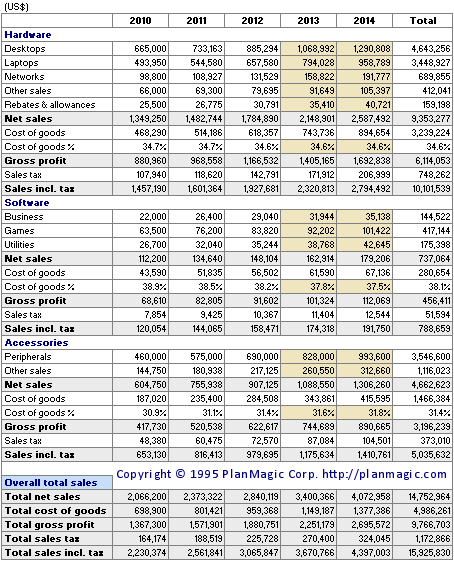

Annual sales projection 5 years

The last two years are pre-filled with average calculations. You may leave as is, or modify as is needed.