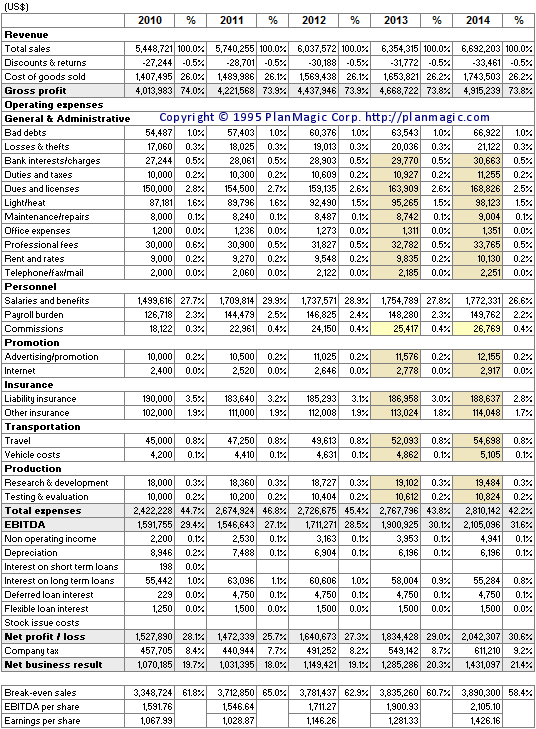

Income statement forecast

The income statements for 3 years (monthly and quarterly) and 5 years (annual) are needed to assess the profit and loss that would occur if your planning is realized.

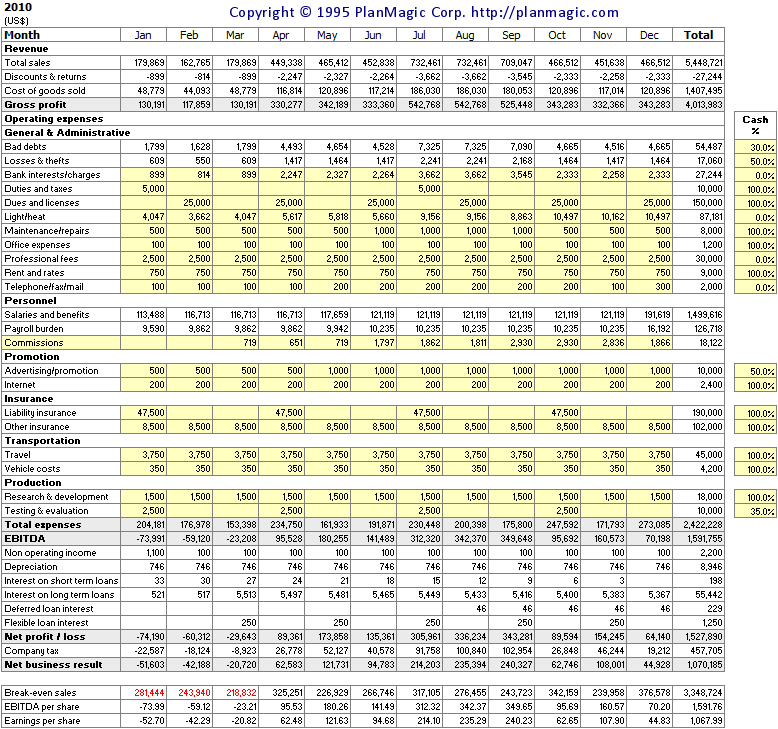

Income statement 3 years

The revenues and cost of goods sold are entered automatically from the Sales Forecast. Discounts & Returns are shown as negative amounts and calculated as a percentage of the gross sales. The discounts & return % is entered in the Assumptions worksheet. For each expense item you can change the cash % to reflect what is paid in cash. The number of days payable is entered in the Assumptions worksheet.

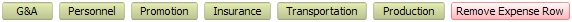

Add additional rows for each category

It is easy to add additional rows to a category. Click on the buttons provided to add additional rows, use the Remove Expense Row to remove a row.

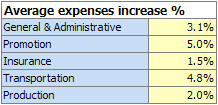

Average expenses increase %

The following 2 years are automated. You only need to enter the Average Expenses Increase % for each category. You may change the resulting values as is needed, but existing formulas will be overwritten.

Income statement quarterly 3 years

The quarterly worksheets are automatically completed from the 3-year Income Statements.

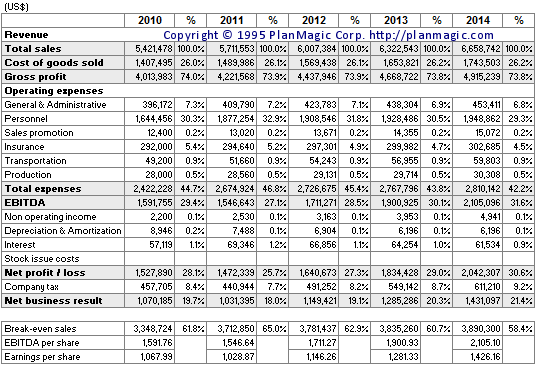

Annual income statement 5 years

The last two years are pre-filled with average calculations. You may leave as is, or modify as is needed.

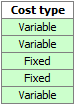

In the Income Statement 5 years worksheet you can select the cost type (variable or fixed) for each row. This enables you to separately enter the variation for each cost type in the Sensitivity Analysis.

By clicking the SUMMARY 5 YEARS button, you can display a 'clean' summary.