Inventory account

PLEASE NOTE: EACH ONE OF OUR BUSINESS SPECIFIC PROGRAMS HAS VERY DIFFERENT INVENTORY CALCULATIONS !

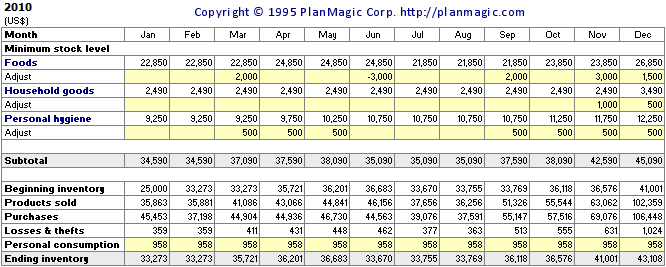

Inventory (products bought for resale, materials bought to manufacture products to be sold, etc.), can't be expensed until sold - and in the meantime are accounted in the stock/inventory asset account in the Balance Sheet. The inventory account table allows you to control the inventory/stock level. The ending inventory is what shows up in the Balance Sheet.

In the Product Details worksheet, you enter the Minimum Stock Level for each product, and in the Inventory Account worksheet you can adjust the minimum stock level if necessary throughout the year. During the high season you may want to increase the stock level, as well as reduce it during the low season.

Losses & thefts

This is automatically calculated using the estimated percentage of inventory for possible losses or thefts entered in the Assumptions worksheet and the Purchases.

Personal consumption (Sole Proprietor/Partnership only)

Many retail business owners use some of their inventory for personal purposes. This has to be properly accounted for and deducted from the purchases. The personal consumption of inventory entered in the Assumptions worksheet is evenly divided throughout the year. You can adjust the amounts if necessary.

In the Assumptions worksheet you also enter:

- Cash purchases %: the percentage of raw material (incl. finished products) purchases that are paid in cash.

- Number of days payable: the average number of days it takes to pay inventory suppliers (30, 60, 90, or 120 days).

- Losses & thefts: an estimated percentage of purchases for each year.

- Personal consumption (Sole Proprietor/Partnership only): an estimated annual amount for each year.