Funding

COMPANIES: Shareholders' capital

There are two classes of stock that companies normally offer: common and preferred. Each type comes with different financial terms and rights in relation to the governance of the company.

Common stock

The holders of common stock have three main benefits being voting rights, capital appreciation and dividends. Capital appreciation occurs when a stock's value increases over the amount initially paid for it. The stockholder makes a profit when he or she sells the stock at its current market value after capital appreciation. Dividends are paid to a company's shareholders from its retained or current earnings. These payments are usually made in the form of cash, but other property or stock can also be given as dividends. Payment of dividends hinges on a company's capacity to grow or at least maintain its current or retained earnings. This means that ongoing payment of dividends cannot be guaranteed. Common stock ownership has the additional benefit of enabling its holders to vote on company issues and in the elections of the organization's leadership team. Usually, one share of common stock equates to one vote.

| Beginning common stock | |

|---|---|

| No. of shares issued | 10,000 |

| Issue price / Par value | 100.00 |

| Common stock value | 1,000,000 |

Preferred stock

Preferred stock doesn't offer the same potential for profit as common stock and in general has no voting rights, but it may provide a more stable investment because it guarantees a regular dividend that isn't directly tied to the market like common stock. This type of stock guarantees dividends, while common stock does not. Dividends on preferred stock are paid first, and if there are retained earnings left, common stock shareholders receive their dividends. The price of preferred stock is tied to interest rate levels, and tends to go down if interest rates go up and tend to increase if interest rates fall.

You can select if you are going to issue preferred stock and enter the details.

| Beginning preferred stock | |

|---|---|

| No. of shares issued | 2,500 |

| Issue price | 150.00 |

| Preferred stock value | 375,000 |

The beginning stock, common and preferred, entered here will show up in the Beginning Balance Sheet.

Capital input

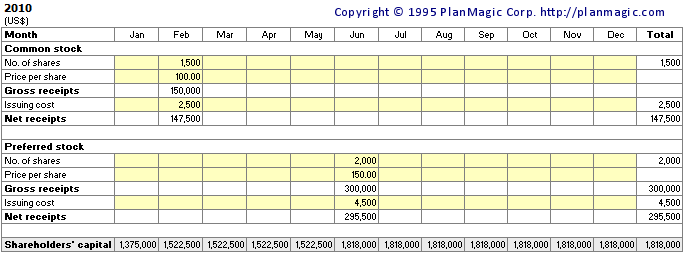

Increase or decrease the number of shares (both common and preferred stock) throughout the 5-year projection. Gross receipts and issuing costs will show up in the Cash Flow and the Income Statement worksheets.

SOLE PROPRIETORS: Proprietary capital

In case of a sole proprietor or partnership, you simply enter the beginning capital, plus any additional capital inputs throughout the 5-year projection. For partnerships we have an additional tool where you can keep details on each partner's account.